9 Simple Techniques For Bank Code

Wiki Article

See This Report about Bank Reconciliation

Table of Contents8 Simple Techniques For BankingSome Known Questions About Banking.Bank for BeginnersGet This Report about Bank Code

You can likewise save your cash as well as earn passion on your financial investment. The cash stored in the majority of financial institution accounts is federally guaranteed by the Federal Deposit Insurance Coverage Corporation (FDIC), approximately a limitation of $250,000 for individual depositors and also $500,000 for jointly held down payments. Banks also give credit scores opportunities for individuals and also corporations.

Banks make an earnings by charging even more interest to debtors than they pay on interest-bearing accounts. A financial institution's size is figured out by where it lies and who it servesfrom small, community-based organizations to huge industrial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured industrial financial institutions in the United States since 2021.

Traditional banks supply both a brick-and-mortar location as well as an on the internet existence, a new fad in online-only financial institutions emerged in the very early 2010s. These banks commonly provide customers higher passion prices and lower costs. Convenience, rate of interest prices, and charges are a few of the factors that help consumers choose their favored banks.

The Ultimate Guide To Bank Draft Meaning

banks came under intense scrutiny after the international monetary crisis of 2008. The regulatory setting for financial institutions has because tightened substantially therefore. U.S. banks are managed at a state or nationwide level. Relying on the structure, they might be controlled at both levels. State financial institutions are controlled by a state's department of financial or department of banks.

You should take into consideration whether you intend to keep both organization as well as personal accounts at the very same bank, or whether you desire them at different banks. A retail financial institution, which has standard banking solutions for clients, is one of the most proper for daily financial. You can select a traditional financial institution, which has a physical building, or an on the internet bank if you do not want or need to physically see a financial institution branch.

, for instance, takes down payments and also lends locally, which might supply a more customized banking partnership. Pick a convenient location if you are selecting a financial institution with a brick-and-mortar place.

The Bank Reconciliation PDFs

Some financial institutions likewise provide smartphone applications, which can be valuable. Inspect the charges associated with the accounts you desire to open. Financial institutions bill passion on finances along with regular monthly upkeep costs, overdraft account costs, and also wire transfer charges. Some large financial institutions are moving to finish over-limit costs in 2022, to ensure that could be an essential factor to consider.Finance & Advancement, March 2012, Vol (bank reconciliation). 49, No. 1 Establishments that match up savers as well as consumers help make certain that economies operate smoothly YOU have actually obtained $1,000 you do not need for, state, a year and wish to check over here gain income from the money up until after that. Or you desire to purchase a home and also require to borrow $100,000 and also pay it back over 30 years.

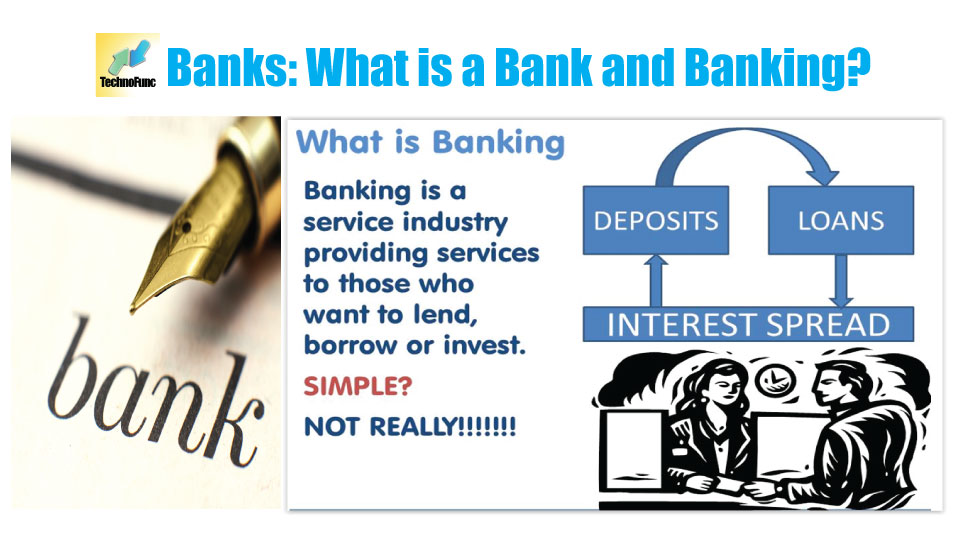

That's where banks can be found in. Banks do several points, their main role is to take in fundscalled depositsfrom those with money, swimming pool them, and also provide them to those that require funds. Banks are middlemans in between depositors (that offer cash to the financial institution) and customers (to whom the bank provides money).

Depositors can be people as well as houses, economic and also nonfinancial companies, or nationwide and also neighborhood federal governments. Consumers are, well, the very same. Down payments can be readily available on need (a monitoring account, for instance) or with some limitations (such as cost savings as well as time down payments). While at any kind of provided minute some depositors require their cash, a lot of do not.

Some Known Details About Bank Account

The process includes maturation transformationconverting temporary obligations (deposits) to long-term assets (fundings). Banks pay more info here depositors much less than they get from debtors, which difference accounts for the bulk of banks' earnings in the majority of countries. Banks can complement typical down payments as a source of financing by straight borrowing in the cash and also resources markets.

Banks keep those needed bank of america login books on down payment with reserve banks, such as the U.S. Federal Reserve, the Bank of Japan, as well as the European Central Bank. Financial institutions create cash when they offer the remainder of the money depositors provide. This money can be made use of to buy items and services and can discover its method back right into the financial system as a down payment in an additional financial institution, which after that can offer a fraction of it.

The size of the multiplierthe amount of money produced from a first depositdepends on the quantity of cash financial institutions have to keep book (bank). Banks also lend and reuse excess cash within the economic system as well as produce, distribute, and also profession protections. Financial institutions have a number of methods of generating income besides pocketing the difference (or spread) in between the passion they pay on down payments and also obtained money as well as the interest they collect from customers or safety and securities they hold.

Report this wiki page